Easy-to-Execute Strategies to Prospect and Retain Customers

Every financial advisor needs to not only prospect new customers, but effectively retain their current client-base. A lack of strong prospecting methods and tactics could lead to the loss of important future business, sometimes creating extraneous effects in the long-term. If potential customers happen to be onboarded, such prospecting tactics won’t add any benefit without the use of a solid retention plan. Retention plans are essential to the prospecting process, as they reinforce the efforts done when bringing in new business. When strong prospecting methods and retention strategies harmonize, they can minimize time wasted and save money.

Without strong recruiting methods there are no customers to serve, and without proper retention techniques, advisors will waste time and money always seeking new clients. Stop the cycle and keep expanding your client base.

This blog will break down the ten easiest tips to recruit and retain customers as a financial advisor.

Strategies For Prospecting

1. Leverage Multiple Channels

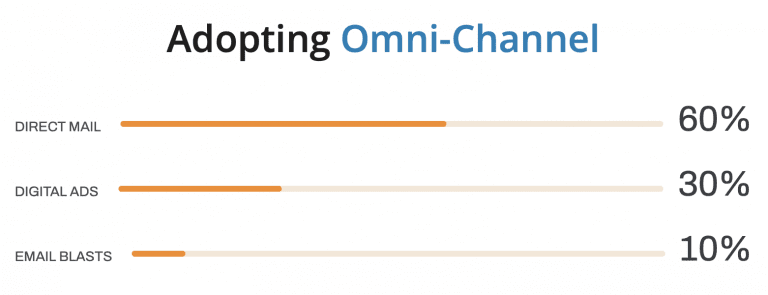

Leveraging multiple marketing channels will ensure that you cover all your marketing bases. Based on a potential client’s behavior, some marketing channels service them better than others. We recommend you take advantage of as many channels as possible that make sense for your business. Specifically, Facebook, email, direct mail, and radio can help accelerate your awareness if used in tandem. We’ve developed our Omni-channel strategy that goes as follows:

Omni-channel

The Omni-channel campaign starts with direct mail. In an industry that requires trust and transparency, print marketing gives you the opportunity to build rapport as well as provide ample information about your expertise and events. We then deploy digital ads by utilizing Google, Facebook, and the Audience Network. Finally, our email blasts include your reference mail piece in print. These are then sent out to thousands of potential customers in your area.

2. Follow-Ups

It is key to follow up with all prospective customers, especially ones that have been to your events, to increase the chances of them becoming clients. Follow-ups make potential clients feel like you care about them and their success, not just their pocketbooks. It always feels good to know that someone is invested in you as a customer or client. Additionally, follow-ups will make the customer experience feel more personal, which people appreciate.

These follow-ups are also a great opportunity to learn more about these potential clients and their financial goals. Understanding which big life events they may be experiencing now or in the near future can help you properly build their financial plan. You might be able to see their financial goals before they even do.

3. Underserved Markets

Most financial advisors purely focus on targeting the same retirees or pre-retirees. However, there are other demographics that need your services. Many financial advisors neglect the millions of women that handle their own finances. This is a huge market that isn’t flooded with other advisors. Take advantage of this opportunity and other underserved markets. Using a different approach than others can be prosperous as well, such as assisting with estate planning. Be the advisor to help these customers protect their money and homes

Less competition means it will be easier to recruit new clients. Don’t be the advisor that lets hundreds of clients slip through their fingers, because they aren’t the “typical” targets.

4. Entertaining Client Events

Connect with potential clients and have fun while doing it! Some events that have brought in large crowds include shred events, picnics, movie nights, and seasonally appropriate giveaways. Neither you nor clients want to drag through another boring client event. Having events people actually want to be a part of will inherently increase attendance. Therefore, more potential clients will be at these events, because there are more people there in general. Then, after the event, attendees are more likely to recommend your events to friends, family, colleagues, etc.

5. Community Involvement

A great way to get your face out in the community, in a positive light, is to volunteer or put on charity events. This allows you to not only give back to your community, but also gain positive exposure. These events are also great to post on your social media pages, because more people will see what great work you’re doing for your community. People want to be able to trust their advisor. Showing them how much you care for your community is a great way to exemplify your trustworthiness.

Strategies to Retain Customers

1. Automate Tedious Tasks

Automating tedious tasks allows for you to direct all your attention to more important matters. Our system will be your assistant’s best friend. It allows you to automate event registration, event confirmations, direct email and text, sign-in sheets, creating day-of name tags, CRM integrations, demographic analytics, landing pages, and manages waitlists! All of these pesky but necessary tasks are completely done by our system. This allows you or your assistant to focus on more important matters. You’re busy, and we know that. That’s why we provide you with all the necessary tools to pull off a flawless event. Let us take care of the busy work.

2. Be Transparent

Transparency is essential for advisor-client relationships. Be honest with them about their goals and expectations. This will inherently build trust between you and the client. If you allow them to have unrealistic expectations, then you set yourself up to disappoint them later. A disappointed client will not likely stay a client.

If a mistake is made, it is essential to be upfront with what went wrong. This honesty will be appreciated, and might help you avoid a more serious conversation down the road.

3. Customer Feedback

Offer customers an avenue to provide feedback during and after their experience. This will make clients feel like you value their opinion. It will also help you improve your practices. Use their feedback as a tool for enhancing your clients’ experiences. Pay special attention to keywords or phrases that seem to be repeated often in feedback forms. These will let you know which aspects of your business customers like the most and the least. Highlight the positive aspects and make changes to improve the negative ones.

4. Gauge Client Loyalty

Try your best to gauge how loyal your clients are to you. Have they recommended you to anyone they know? How many years have they been your client? How much money have they allowed you to invest? All these questions are important to ask yourself when gauging client loyalty. If a client has never made a recommendation, is relatively new, and has only given you a small percentage of their money, they are more likely to switch financial advisors. Pay special attention to the people that are more likely to leave you down the line. Turn these customers into loyal clients.

5. Quality Customer Service

The most obvious way to retain clients is to have good customer service, so you would be shocked to know how many advisors fail to provide it. Promptly answering emails and returning phone calls gives the impression that this client is important to you. Their time is valuable too, so try not to keep them waiting for days on an answer to their question.

You should also employ the tactics stated above to enhance your clients’ experience. Automation, transparency, customer feedback, and client loyalty are all important factors to improving your game.

Don’t waste time and money by ignoring these easy fixes to improve your recruitment and retention.

With LeadJig financial services marketing, you can generate a consistent stream of qualified prospects to use for future financial seminar events, workshops, roundtable events, and more. Request a demo of our services today.